What is Payment Orchestration?

Payment orchestration is a platform that connects numerous parts of the payment process in one place. By offering a wide range of payment options, this approach empowers retailers and merchants to enhance the customer experience while simplifying the overall payment process.

How Does a Payment Orchestration Platform Work?

Payment orchestration platforms seamlessly integrate with multiple payment service providers, using automated transaction routing to automatically identify the optimal route for processing payments and monitoring transactions in real-time.

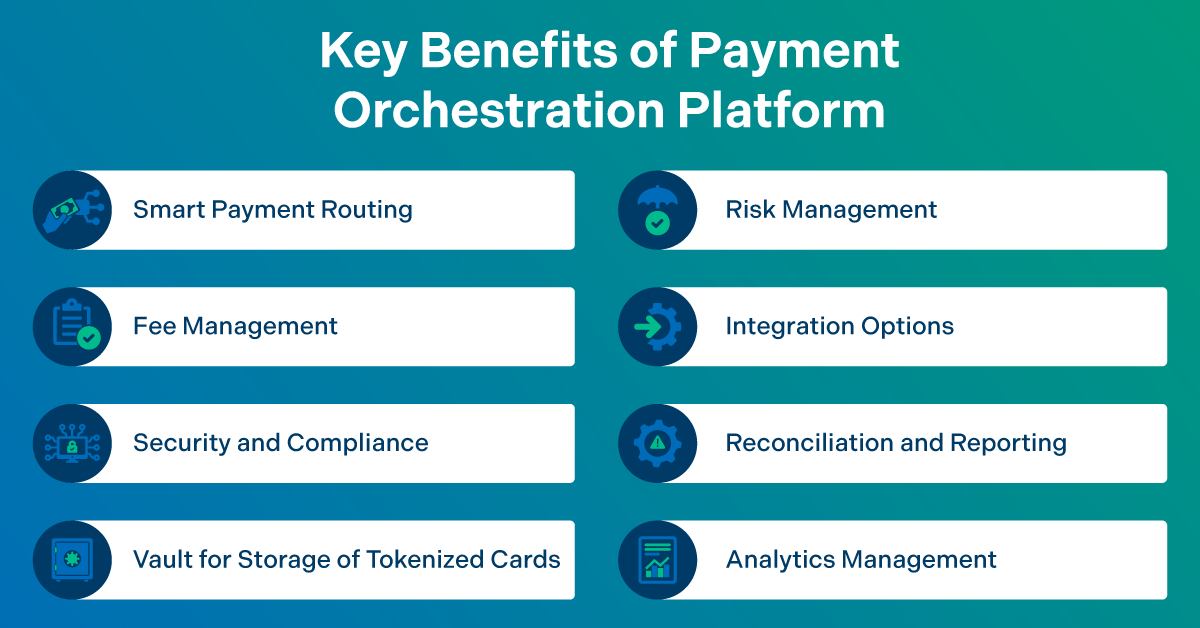

What Are the Key Benefits of Payment Orchestration Platforms?

Integration with Multiple Payment Service Providers

Payment orchestration platforms integrate with multiple payment service providers including digital wallets and credit card processors. This enables the accommodation of diverse customer preferences, ultimately leading to increased successful transactions. It has emerged as a pivotal tool, offering a range of functionalities that facilitate seamless transactions and enhance overall operational effectiveness. From smart payment routing to robust risk management, orchestrators play a crucial role in optimizing payment processes for businesses in e-commerce across various industries.

Automated, Smart & Dynamic Payment Transaction Routing

One of the primary functionalities offered by payment orchestrators is smart payment routing. This feature enables businesses to dynamically route transactions through the most cost-effective and efficient payment channels. By analyzing factors such as transaction volume, currency conversion rates, and payment method preferences, orchestrators ensure that each transaction follows the optimal path, minimizing costs and maximizing acceptance rates.

Integration Options

Seamless integration with existing systems and third-party applications is essential for maximizing the value of payment orchestration. Orchestrators offer flexible integration options, including APIs (Application Programming Interfaces) and SDKs (Software Development Kits), allowing businesses to integrate payment functionality into their websites, mobile apps, and backend systems with ease.

Risk Management

Payment orchestration solutions usually include risk management features to prevent fraud and enhance security throughout the payment process. Mitigating payment-related risks such as fraud and chargebacks is a top priority for businesses of all sizes. Payment orchestrators employ advanced risk management tools and fraud detection algorithms to monitor transactions in real-time, identify suspicious activity, and prevent fraudulent transactions before they occur. This proactive approach helps businesses minimize losses and protect their reputation.

Reducing False Declines

When routing transactions, payment orchestration platforms aim to minimize false declines. This can lead to enhanced user experience and optimized transactions.

Transaction Monitoring, Reconciliation and Reporting

In addition, the platform monitors transactions in real-time and provides businesses with comprehensive reporting and analytics. This leads to the enhancement of the businesses’ workflow as they can gain in-depth insights into their payment processes, track their performance, and identify any areas of improvement. Effective reconciliation and reporting are essential for financial transparency and accountability. Payment orchestrators offer robust tools for reconciling transactions, tracking payment status, and generating comprehensive reports. This functionality streamlines accounting processes, reduces manual errors, and provides valuable insights into payment trends and performance metrics.

Management Information

Access to real-time management information is vital for making informed business decisions. Payment orchestrators provide customizable dashboards and reporting tools that offer insights into transaction volumes, revenue trends, and customer behavior. This data-driven approach enables businesses to identify opportunities for growth, optimize operational efficiency, and enhance the overall customer experience.

Fee Management

Managing transaction fees and processing costs is a critical aspect of payment operations. With a payment orchestration platform in place, businesses can manage and optimize transaction costs by accessing insights into the fees charged by different payment service providers. This helps companies choose cost-effective routes for financial transactions. By optimizing fee structures and negotiating favorable terms, businesses can minimize expenses and maximize profitability without compromising service quality.

Vault for Storage of Tokenized Cards

Security is paramount in the world of digital payments, and orchestrators address this concern by providing a secure vault for the storage of tokenized cards. Tokenization replaces sensitive card data with unique tokens, reducing the risk of data breaches and unauthorized access. By centralizing tokenized card storage within the orchestrator, businesses can maintain compliance with industry regulations such as PCI-DSS while safeguarding customer payment information.

Security and Compliance

Adhering to strict security standards and regulatory requirements is non-negotiable in the payment industry. Payment orchestrators implement robust security measures such as encryption, tokenization, and multi-factor authentication to safeguard sensitive data and ensure compliance with global regulations such as GDPR and PSD2. By prioritizing security and compliance, orchestrators instill trust and confidence among customers and stakeholders.

Payment orchestration offers a comprehensive suite of functionalities that empower businesses to optimize payment processes, enhance security, and drive business growth. From smart payment routing to advanced risk management, orchestrators play a pivotal role in enabling seamless transactions and ensuring compliance with regulatory standards. By leveraging the capabilities of payment orchestration, businesses can unlock new opportunities for efficiency, innovation, and success in today’s dynamic digital economy.