In the rapidly growing online payment industry, businesses often find themselves confused when deciding between payment orchestration vs payment gateway solutions. This choice becomes crucial as they strive to select the ideal platform tailored to their specific needs.

In this article, we will discuss everything about payment orchestration and payment gateways, how they work, their benefits as well as their key differences. So let’s dive into it!

What is a Payment Orchestration solution?

Α payment orchestration platform connects numerous parts of the payment process in one place. By offering a wide range of payment options, it empowers retailers and merchants to enhance customer experience while simplifying the overall payment process.

How does a payment orchestration work?

Usually, payment orchestration platforms integrate with multiple payment service providers using automated transaction routing to identify the optimal route for processing payments and monitoring transactions in real-time.

Key Benefits of Payment Orchestration

- Automated, Smart & Dynamic Payment Transaction Routing

One of the key benefits of payment orchestrators is the smart payment routing. This functionality empowers businesses to dynamically direct transactions through the most cost-efficient and effective payment channels. Through the analysis of specific factors such as transaction volume, currency conversion rates and payment method preferences, orchestrators ensure that each transaction follows the optimal path, minimizing costs and maximizing acceptance rates.

2. Integration with a wide range of payment service providers

Payment orchestration platforms seamlessly connect with various payment service providers, encompassing digital wallets and credit card processors. This integration caters to a wide array of customer preferences, resulting in a higher rate of successful transactions. These platforms have become essential tools, providing multiple features that streamline transactions and improve overall operational efficiency. From intelligent payment routing to robust risk management, orchestrators play a vital role in optimizing payment processes for businesses in every industry.

3.Transaction Monitoring, Reconciliation and Reporting

Furthermore, payment orchestrator solutions monitor real-time transactions and provide businesses with thorough reporting and analytics. This results in an improved workflow for businesses, allowing them to delve into detailed insights regarding their payment processes, monitor performance, and pinpoint areas of enhancement. Robust reconciliation and reporting are imperative for financial transparency and accountability. Payment orchestrators provide powerful tools for reconciling transactions, monitor payment status and generating comprehensive reports.

4. Vault for Storage of Tokenized Cards

In the realm of digital payments, security takes precedence and orchestrators tackle this issue by providing a secure vault dedicated to storing tokenized cards. Tokenization involves substituting sensitive card data and distinct tokens, diminishing the likelihood of data breaches and unauthorized access.

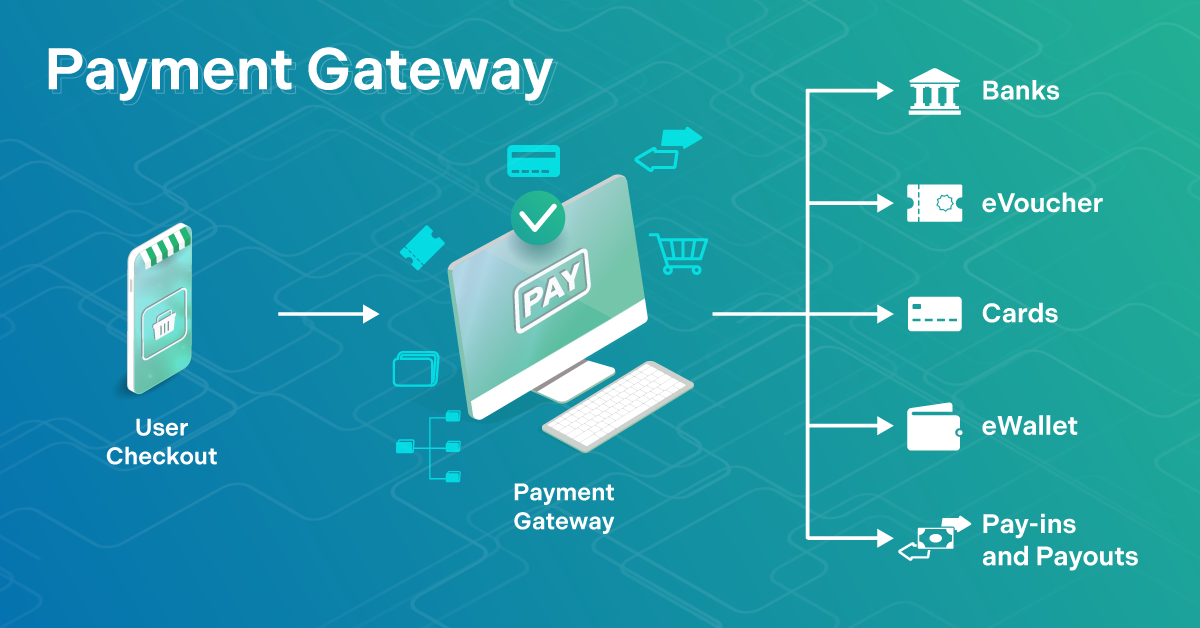

What is a Payment Gateway solution?

A payment gateway is a payment service that facilitates the processing of online payments for businesses. It acts as an intermediary between the merchant’s website and the payment processor where it securely transmits payment information.

How does a Payment Gateway work?

A payment gateway enables businesses to receive payments from customers via online platforms. Upon a customer placing an order on a website, the payment gateway encrypts the payment information and transmits it to the processor for authorization. Subsequently, the processor verifies the transaction details, and upon approval, the payment gateway sends a confirmation message back to the merchant’s website.

Key Benefits of Payment Gateway

- Localized Payment Methods

An essential characteristic of a payment gateway lies in its ability to adapt to varied consumer preferences and regional payment landscapes. To cater to a global audience, payment gateways extend beyond traditional payment options and effortlessly incorporate a variety of localized payment methods. These methods encompass digital wallets and other alternative payment options.

2. Faster Payment Processing

Payment gateways enable businesses to receive payments instantly while eliminating the need for traditional payment methods like cash. Therefore, the speed of the payment process is very likely to be increased while the cash flow of the business will be enhanced. Other than that, by automating the payment process, payment gateways can process transactions faster, resulting in quicker payments for businesses.

3. Global Reach

Payment gateways enable businesses to accept payments from customers around the globe. As a result, the customer base can be expanded and opportunities for international sales might be opened. Furthermore, a payment gateway solution can be combined with a cross-border service that promises secure, swift, and seamless global money processing.

Payment Orchestration vs Payment Gateway

Scope and Functionality

Payment gateway solutions act as an intermediary between an online merchant’s website and the financial institutions involved in the transaction. It primarily handles the authorization and secure transmission of payment data between the customer, merchant, and the payment processor. On the other hand, payment orchestration solutions encompass not only the routing of transactions to payment gateways but also the management of multiple payment service providers, acquirers, and alternative payment methods. Payment orchestration aims to optimize the entire payment process by dynamically routing transactions to the most suitable payment service provider.

Flexibility and Adaptability

Payment gateways are typically tied to specific payment methods or acquirers. Merchants using a payment gateway may need to integrate with multiple gateways to support various payment options. In contrast, payment orchestrations provide flexibility by allowing merchants to integrate with a single platform and access multiple payment gateways and service providers.

Dynamic Routing

On the one hand, payment gateways usually follow a static routing model where transactions are directed to a predefined payment processor or acquirer. On the other hand, payment orchestration solutions enable dynamic routing making the transactions intelligently directed to multiple payment gateways based on real-time factors such as currency, transaction volume and the performance of each payment service provider.

Risk Management

In payment gateways, risk management features are often handled within the payment gateway itself, including fraud detection and prevention tools while payment orchestration solutions may offer enhanced risk management capabilities by analyzing data across multiple payment service providers, enhancing overall transaction security.

How can OKTO boost your business?

Transform your business with OKTO’s payment orchestration solution. Experience unparalleled market growth through instant pay-ins and payouts, facilitated by our seamless integration of multiple local payment methods across multiple regions. OKTO consolidates providers into a unified platform, saving you time and resources.

Enhance flexibility by selecting from a diverse array of payment methods, including credit cards, digital wallets, and open banking, tailored to your specific needs. Enjoy optimized performance with increased transaction success rates, anti-fraud measures, and exceptional user experience. Our smart routing ensures seamless processing, maximizing revenue potential.

Prepare for future scalability with automated reconciliation and comprehensive reporting. As your business expands, OKTO scales effortlessly, supporting your journey into new markets. Revolutionize your payment strategy today and unlock efficiency, flexibility, and performance like never before.

Wrapping Up

Whether businesses opt for payment orchestration or a payment gateway, both offer a myriad of benefits, each serving unique purposes. A payment gateway primarily acts as an intermediary in electronic financial transactions. In contrast, a payment orchestrator goes a few steps further, optimizing the entire payment process from start to finish by dynamically managing multiple payment providers. By discerning the disparities between payment orchestration and payment gateway, businesses can make informed choices about the technology best suited to enhance their payment processes, ultimately elevating the overall customer experience.